10 Ways to Save Money Using Cash

I have 10 ways to save money using cash today. Which do you find more painful, handing dollar bills over the counter or swiping a piece of plastic? If you’re like most, you find it much more difficult to hand over your cash when you’re making a big purchase. Stop and think about that.

If you know that you have a spending problem but find it more painful to hand all those Washington’s to the cashier, wouldn’t it be a wise move on your part to use cash instead? You’d be surprised how much money you would be saving by using this strategy.

Take a look at these 10 ways to save money using cash. Don’t forget to go to the bottom of this post to see a FREE PRINTABLE CALENDAR, and grab some cardstock.

How to Save Money Using Cash

When it comes down to it, saving money is important. Most people these days don’t use cash because it’s not convenient. I’m here to tell you that cash can actually help you save money in the long run! Keep reading to discover my tips.

1. Stay On Budget

You probably realize that wandering aimlessly will never get you to the destination you’re hoping to end up.

The same thing can be said about your finances. Poor spending habits with no budget in mind is like trying to hit the retirement bullseye while blindfolded.

If you’re consistently and carelessly spending money at sit-down restaurants and getting a new cute pair of shoes every few months, you’re never going to get anywhere.

Why do we treat our finances this way? What are the financial goals that you hope to achieve when you’re older? A budget can set you on the right course.

Trying to break free of that old lifestyle isn’t going to be easy, but you need to start somewhere. And sooner, rather than later. Sit down and find out what all your expenses are, and make sure that you’re not spending cash on things outside your budget.

While we’re not telling you to completely stop spending money on fun and entertainment, you certainly need to set a limit on it.

2. Know What You Have to Spend

Having cash-on-hand is also great for helping you stick to a budget. Once that money is gone, there’s no spending after that.

This mentality is also great while you’re heading to the grocery store. Before you walk into the store, know what you have in your wallet.

Not only will this save you from embarrassment up at the register, but it will help you be more cautious with how many groceries you are putting into your cart. This method can be used on anything besides just the grocery store too.

3. Only Spend what You Have

Cash is also a better method instead of debit/credit cards because you can only spend what you have in your wallet. When the money’s gone, that’s it. Debit/credit cards don’t really keep you to a budget because they give you the feeling like you have the money to spend when in reality, you don’t.

4. Use the Cash Envelope System

Using the cash envelope system is a great way of helping you stick to your budget while using cash. You’ll need to sit down and figure out all your finances.

Next, you’ll want to take the amount of cash required for each expense and put it in the appropriate envelope marked for that expense. This includes house payments, utilities, car payment, food expenses and so on.

Keep in mind that surprises happen from time to time. You might be dealing with a blown tire or needing a new car battery.

For situations like this, it’s okay to take money from other envelopes to help with these situations and survive until the end of the month.

The envelope system might not be for everyone, and that’s okay. Just make sure you find a system that works for you and your budget, and stick with it.

5. Set Aside Cash Left Over Into Savings

Using the envelope system, or whatever other budget systems you come up with, set aside the cash that is left over at the end of the month and roll it over into a savings envelope or savings account.

Just because you have left over money at the end of the month doesn’t mean you should go out on a shopping spree.

6. Forced to Negotiate

Having cash with you at all times can work out for your benefit in other ways too. Consider buying a car for your teenager or heading to a garage sale with a small amount of cash.

Money talks. If you find a steal and don’t have the entire amount for the purchase, offer a negotiation. You’d be surprised how often this works out in your favor.

7. Save Money On Interest

Paying cash instead of using a credit card on major purchases can save you a bunch of money on interest.

You may think you are getting 20% off the sale price purchase in the beginning and you may justify using a credit card. The thing is you will pay more in interest than you will save with 20% off.

8. Consider Cash Purchases based on Hours Worked v.s Cost

When you’re holding your cash in one hand and a certain “future purchase” in the other, consider this.

Don’t look at the cost of that item. Think about the many hours it takes you to work to come up with that amount of money. Is that purchase still worth all those hard hours in the early morning? Chances are, you’ll find that it might not be.

9. The Inconvenience of Withdraws is Actually a Benefit

Having to go to the ATM to make a withdraw for cash might sound incredibly inconvenient. But it actually works for your good. You might have had a spending problem for a long time. You need it to be an inconvenience to help you from spending more money than you need to.

10. Save your Coins

Many people don’t think much about their chump change once that dollar has been broken down. Here are my two cents.

Save your coins. At the end of the month or the next time you have to take out a withdrawal at the bank, convert those coins into cash. I guarantee you’ll be surprised how much money you get back.

Final Word

These are 10 ways that using a cash system can help you save money. Do you use a cash-only system to help with your finances? If so, tell us in what other ways you save using cash, and tell us about your success. May God bless this world, Linda

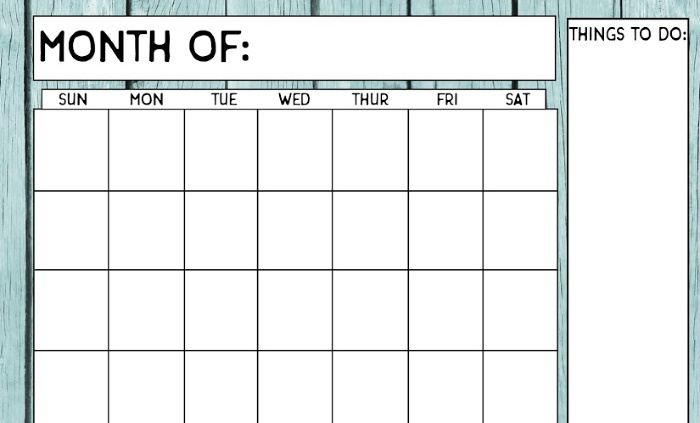

FREE PRINTABLE CALENDAR:

Here is the printable for you to print each and every month each year when you need one. You will print 12, one for each month, they are LETTER SIZE. You fill in the Month and the days for each month. Grab some cardstock if you have some: Food Storage Moms Calendar

How to Live on a Minimalist Budget

Grocery Shopping on a Shoestring Budget

Linda, you made a great point about ” Negotiate ” , i always ask every one i deal with, plumber, electrician, roofer, mechanic, will you do better on the price if i pay you cash. It has saved me hundreds of dollars over the years. Some people are too shy to ask, but almost everyone i have dealt with like CASH for reasons we all know, good information here again Linda..

Hi Hearl, you are always so kind, thank you for your great comment. I even pay cash for my prescriptions if it costs less than my co-pay. It’s amazing how much money I save. Great comment, Linda

I only use my credit card if I know I can pay it at each month. Is this okay or is it costing me some kind of extra money???

Hi Janet, we all need a credit card for charging to rent a car or whatever. It’s when we don’t pay off the balance. You are using yours like cash, keep up the good work, Linda

We never use credit cards because it’s easy to get into trouble with them (trust me, I know). We do use debit cards, but since I keep track of all expenses on a spreadsheet, I always know how much we have. I usually keep some cash in my wallet for take-out dinners. We also have covers on our phones and keep some cash between the cover and back of the phone for emergencies. Last week it was $5 each. We upgraded to $10 each and in a couple of weeks that will be increased to $20.

Most of these suggestions are a band aid for the problem of not being able to control spending and unless you address the root problem it’s not going to work. # 8 I have used for years and you ARE right that this will put perspective into your purchase. # 10 again is a great solution as this will add up to a nice chunk of money over a year period. People that continually run low on cash will just start caring more cash so I don’t feel that is a good solution. I use credit cards all the time and pay them off each month.this gets me about 6-700 a year in points and cash back so I am surprised you don’t mention it. You talk about tracking spending and using spread sheets but if people are willing and able to do these things then they most likely don’t have a spending problem.

Hi Poorman, I totally agree with you about the spending habits of people. I love hearing you earn points from using credit cards and paying them off every month. After working at a few banks for almost 12 years, you are the exception. Most people do not pay them off every month. Way to go, Poorman! Linda

I have two ways that I use to pay cash when a card is required. 1. Bluebird, which is a rechargeable prepaid credit card (with your name on it) that can be bought at Wally World it has the American Express logo on it. I have never been charged a fee so-far 2. Amazon Cash with this you have a bar code on your phone or tablet that you go to certain stores and they scan the bar code ask you how much to apply I always add just enough to purchase the item I want plus S&H and Tax.

Hi S.N. now I have the giggles, Wally World, I love it! Thanks for the tip on these two cards, I love it! Linda